Economics is the study of currency and financial institutions as they relate to individual consumers, households and corporations, as well as individual cities, states and countries. Students who earn a college degree in this field may go on to pursue careers as accountants, financial managers and advisors, bankers, corporate executives and university-level educators. Prospective economists can learn more about the finer points of this profession by enrolling in open courses offered free-of-charge through accredited colleges and universities.

Most undergraduate economics programs highlight the fundamentals of individual and organizational finances, respectively known as the fields of micro- and macro-economics. Graduate-level economics majors often choose specializations that revolve around the role they wish to play in the financial market once they've graduated and entered the workforce. Some will find work with private or public sector organizations, and others will work at the forefront of the industry as independent economic theorists or academic researchers. A deep understanding of how and why money impacts society and its individual members is required for a successful career in economics.

Sample Courses

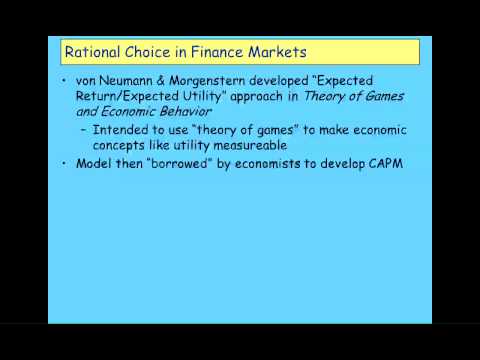

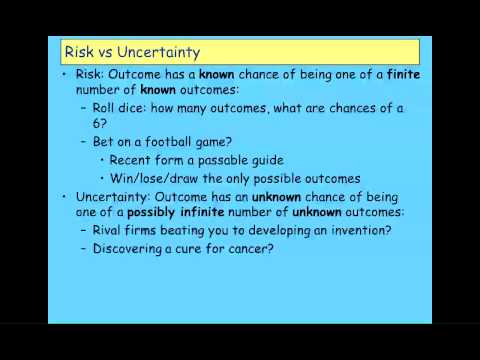

Typically, undergraduate-level economics programs will consist of full course sequences for both micro- and macro-economics. These sequences will begin with introductory courses, and then proceed to discuss Game Theory, industrial organization, supply chain management and other complex concepts that can be applied to virtually any firm or organization. Graduate-level economics majors will often review case studies, research different (and often contradictory) economic theories and explore economic activity in specific countries or regions of the world.

Possible Specializations

Specializations in economics vary between colleges and universities. At some schools, economics itself is considered a specialization of finance or business management, or may be chosen as a minor. Other schools will offer specializations in economics such as international trade and business, mathematics, accounting or statistical analysis. Students who are interested in pursuing a specialization in economics should carefully research their college options to ensure that at least one of the schools offers this type of concentration.

Degree Types

In addition to the specialization, prospective economists must decide which degree(s) to earn in order to effectively compete for jobs. Here is a breakdown of the four most common degrees awarded in the field of economics:

Associate

An associate degree may consist of one or two lower-level economics courses, but this credential emphasizes general education over specialized study. This degree track will introduce key economic concepts and enable students to determine if this field is the right fit for them, but a higher degree will be required for most professional positions.

Bachelor's

Bachelor's degree programs in economics highlight the fundamentals of the field without awarding a specialization. Although a bachelor's degree will be sufficient for some entry-level finance or accounting positions (particularly with the U.S. government), most students use their undergraduate credential as a springboard for attaining a master's and/or doctoral degree in economics.

Master's

According to the Bureau of Labor Statistics (BLS), a master's degree or Ph.D. is required for the majority of economics positions. A master's program will delve into the broad concepts first introduced during undergraduate studies, and allow students to apply what they have learned to real-world markets and organizations.

Ph.D.

This credential will generally be required for anyone who wishes to teach economics at the college or university level, as well as those who want to pursue careers in advanced economic theory. Ph.D. programs usually entail an extensive research project, and many will require the student to complete an internship at a local business, nonprofit organization or financial institution.

In addition to the degrees listed above, certain professionals will be required to complete additional coursework in order to be considered for employment. Accountants, for instance, must pass the CPA Exam in order to earn state certification.

Ideal Candidates for Economics

Economics is a field heavily saturated with numbers and statistics; those who wish to earn a degree and pursue a career in this field should be comfortable working with different data sets and have a solid grasp on different mathematical disciplines. Since economics is difficult for many people to understand, professional economists should also be equipped with presentation skills and the ability to explain complex ideas and theories in a straightforward manner.

Career Pathways

The BLS notes that the field of economics is expected to grow 14% between 2012 and 2022, which is on par with the average rate of growth for all occupations. There are currently about 16,900 economists employed in the U.S. today. Individuals who earn a Master's Degree in Economics earned a median annual salary of $91,860 in 2012.

The BLS points out that employment rates for economists will vary by the sector they choose. Many private firms and organizations have begun to hire more economists to help analyze monetary trends and improve financial performance – but competition for top-tier positions remains high. The federal government, on the other hand, has consistently been the largest employer of professional economists – but the number of hirees expected to land jobs with the government will likely decline in the years to come.

Students who are interested in economics should explore student associations and clubs at their higher-learning institution dedicated to finance, business management, and other related fields. Through these groups, students can network with fellow economists, attend conferences and receive information about employment opportunities. Professional organizations and economics-oriented magazines (such as Forbes and Fortune) are also great resources for aspiring economists.